What Is Volatility and How Do You Handle It in Crypto?

Introduction

Crypto headlines never stop buzzing about wild price swings, epic bull runs, and meme coin moonshots. If you’re asking, “What is volatile?” or “Is crypto volatile?”—rest assured, there’s a lot to unpack. This beginner-friendly guide breaks down crypto market volatility, explains why it’s such a big deal, how you can actually navigate it, and why understanding your own psychology is just as vital as watching the charts. Not financial advice—always do your own research.

What Is Volatility?

Volatility measures how much the price of an asset goes up and down over time.

- In simple terms: high volatility = wild price swings.

- In crypto, these swings can happen in a matter of hours (or even minutes), compared with more gradual moves in stocks or bonds.

Volatility isn’t all bad. It just means uncertainty—the market has no clear direction. Sometimes it rockets up with hype, other times it dives on scary news.

What Is Market Volatility?

“Market volatility” refers to rapid, unpredictable changes across the entire marketplace, such as all cryptos or stocks moving in wild swings at once.

- In crypto, that often means headlines like, “Bitcoin dropped 20% in a day!” or “Dogecoin tripled overnight.”

Volatility can translate into risk (potential loss), but also opportunity (potential gain).

Cryptocurrency Volatility Explained

Why Is Crypto So Volatile?

Cryptocurrencies aren’t just a little unpredictable—they’re officially among the most volatile assets you can buy.

Here’s why:

- New and Unregulated: Crypto is still young and less regulated than stocks, so news and rumors have outsized impact.

- Speculation: Many buy crypto not for utility, but as a speculation—hoping it’ll spike so they can sell for profit.

- Low Liquidity: It only takes small trades to move prices big distances, especially with altcoins and meme coins.

- Herd Mentality: Fear and greed take over quickly. People FOMO in when prices rise, and panic-sell when they fall.

- Whale Moves: Big holders (“whales”) dumping or buying can move the whole market.

- Global 24/7 News: Markets never close, so global events and social media can impact prices instantly, at any hour.

Real-World Crypto Examples

- Bitcoin Bull Runs: In late 2024, Bitcoin leapt from $52,636 to over $108,410 in just three months—then retraced sharply, showing classic crypto market volatility.

- Meme Coins: Coins like Dogecoin or newer meme coins can go up thousands of percent on hype, only to crash just as quickly.

- Corrections & Crashes: Over its history, Bitcoin has had over eight 50%+ drops, each time followed by rallies to new highs.

How Is Volatility Measured?

- Historical Volatility: Measures price swings over a fixed window (30 days, one year, etc.).

- Implied Volatility: Prediction of future swings—used by traders and option markets.

- Standard Deviation & Beta: Other calculations gauge how much prices deviate from the norm or from the broader market.

Crypto vs Traditional Asset Volatility

| Asset | Typical Annualized Volatility (%) | Risk Level |

|---|---|---|

| Bitcoin (BTC) | 135% | Very high |

| S&P 500 (Stocks) | 17% | Moderate |

| US Treasury Bonds | 4% | Low |

Crypto vs Traditional Asset Volatility (%)

Bitcoin’s volatility dwarfs stock or bond markets, illustrating why crypto market volatility is a special topic for investors.

Highs, Lows, and Market Events

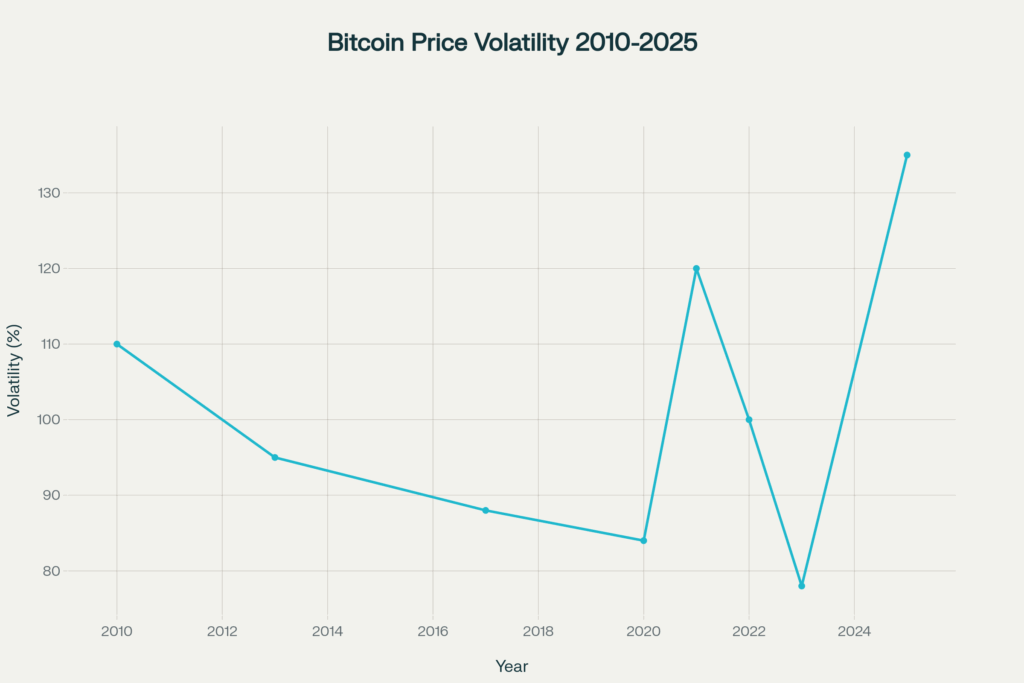

Here’s a historical look at Bitcoin’s volatility across major cycles:

Bitcoin Price Volatility from 2010 to 2025 (annualized %)

Periods like bull runs and bear markets cause huge spikes—sometimes over 100% volatility—while other times it’s relatively calm.

The Psychology of Investing in Volatile Crypto Markets

Understanding volatility isn’t just about numbers—it’s about managing your emotions and reactions.

Common Psychological Traps

- FOMO (Fear of Missing Out): Chasing rallies, buying high, and risking big losses.

- Panic Selling: Dumping assets during crashes, locking in losses instead of riding out the storm.

- Overconfidence: Believing “this time is different” and taking on bigger risks.

- Revenge Trading: Doubling down after losing money, often leading to more loss.

How to Build Mental Resilience

- Set Realistic Expectations: Accept that volatility means both fast gains and losses. Don’t expect constant profit.

- Have a Trading Plan: Define entry/exit points, risk limits, and stick to them. “Failing to plan = planning to fail”.

- Journal & Reflect: Document your trades, emotions, mistakes, and lessons.

- Know Your Triggers: Are you driven by hype, fear, or boredom? Being self-aware helps prevent rash decisions.

Practical Tips for Handling Crypto Volatility

1. Dollar-Cost Averaging (DCA)

Buy a fixed amount at regular intervals—regardless of price swings. This smooths out the effects of volatility and helps avoid buying at market tops.

2. Diversification

Spread investments across assets: mix high-volatility coins, stablecoins, and even some stocks or bonds.

3. Use Volatility Indicators

Learn tools like the Average True Range (ATR), Standard Deviation, and Choppiness Index to set smart stop-losses and manage risk.

4. Position Sizing

Invest less in coins that swing wildly; don’t let a single trade risk too much of your portfolio.

5. Avoid Excessive Leverage

Leverage amplifies volatility—small moves can cause big losses. Keep it low or avoid it entirely, especially as a beginner.

6. Stay Informed

Follow reliable financial news, regulatory updates, and crypto analytics. Changes in policy or sentiment can move markets in minutes.

7. Use Stop-Losses

Pre-set levels where your investment will be automatically sold if the price drops too far. Helps limit potential loss during wild swings.

8. Long-Term Perspective (“HODL”)

History shows that patience yields better results than short-term speculation. Many who “hodl” Bitcoin over years have fared better than frequent traders.

Common Mistakes to Avoid

- Day Trading Without Strategy: Quick profits are possible but rare for beginners. Most lose money.

- Ignoring Fees: Frequent trading racks up costs, eating into returns.

- Chasing Trends Blindly: Don’t blindly follow X/Twitter or Reddit hype.

- All-In Bets: Never bet more than you can afford to lose.

FAQ: Cryptocurrency Volatility

Why is crypto so volatile?

Crypto is new, less regulated, and heavily driven by speculation, global news, and major holders (“whales”). Low liquidity and 24/7 trading also contribute.

What is cryptocurrency market volatility?

It’s the rapid, unpredictable price swings across digital assets—much more dramatic than in most traditional investments.

Is crypto volatile compared to stocks?

Extremely! Bitcoin’s annualized volatility can exceed 100%, while stocks like the S&P 500 average 17%.

How do I handle crypto market volatility?

Use dollar-cost averaging, diversify, learn volatility indicators, set stop-losses, keep position sizes small, and maintain a long-term perspective.

Can you predict crypto volatility?

Not perfectly. While tools and historical data help, sudden news or market sentiment shifts can trigger swings instantly.

What’s the safest way to invest in crypto?

There is no “safe,” only “safer.” Spreading bets, limiting position sizes, and using risk management tools are key.

When does crypto volatility increase?

During major market events (e.g., regulatory news, financial crises, bull runs, or sudden sell-offs by whales).

Disclaimer

This content is for educational purposes only and should not be considered financial advice. Cryptocurrencies are highly volatile and can result in losses. Do your own research and consult a qualified financial advisor before investing.

Conclusion

Volatility isn’t just what makes crypto exciting—it’s what makes it risky.

By understanding what is market volatility and why crypto market volatility matters, new investors can take smarter, more confident steps. Use practical strategies and build your investing psychology. Stay patient, keep emotions in check, and aim for long-term growth. Want to learn more about mastering crypto volatility? Keep exploring educational resources, or join communities focused on transparency and knowledge.